AP Syllabus focus:

‘Government initiatives at different scales, including tariffs, can influence trade flows and economic development.’

Governments shape global economic interactions by imposing tariffs and related trade policies that redirect trade flows, influence domestic industries, and alter development trajectories across world regions.

Government Trade Policies and Their Development Impacts

Government trade policies are deliberate actions taken by national, regional, or local authorities to regulate international trade. Among these policies, tariffs—taxes placed on imported goods—are a central tool used to influence economic conditions and shape development outcomes. Because tariffs directly affect prices, consumer behavior, industrial competitiveness, and global market connections, they play a major role in determining how countries participate in the world economy.

Tariffs as a Policy Tool

A tariff is a tax applied to a good when it crosses an international border.

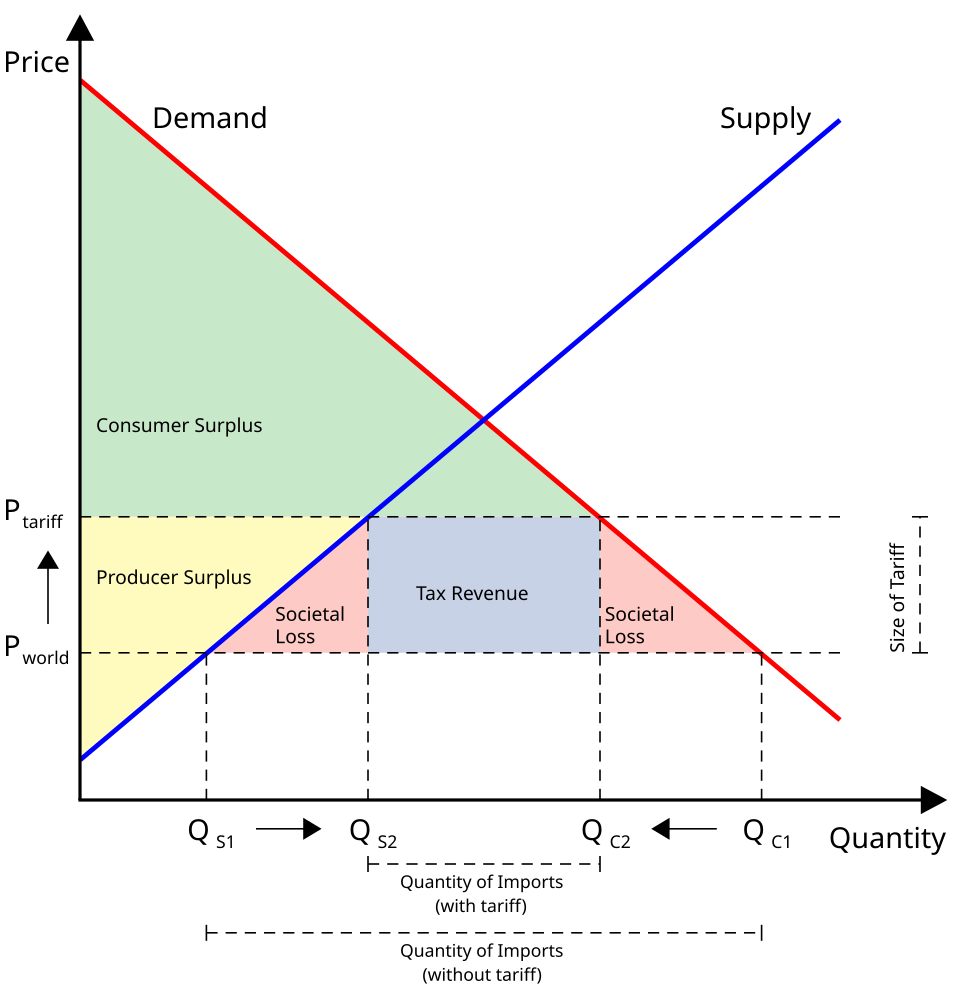

A supply-and-demand diagram illustrating the effect of an import tariff on a domestic market. The tariff raises the price above the world price, reduces the quantity of imports, and generates government revenue while creating deadweight loss. Some shaded areas include additional economic detail beyond the syllabus emphasis on trade flows and development. Source.

Tariff: A tax imposed on imported goods that raises their price relative to domestic products.

Tariffs function by increasing the cost of foreign goods within a domestic market. This price change influences economic behavior by encouraging consumers to purchase domestically produced alternatives and by reshaping the competitive landscape for businesses. Governments implement tariffs for several reasons, each connected to broader development goals.

Reasons Governments Use Tariffs

Governments typically introduce tariffs to shape economic development. These motivations include:

Protecting infant industries to allow new domestic sectors time to grow.

Shielding existing domestic industries from foreign competition to preserve jobs and production capacity.

Generating government revenue, especially in low-income countries with limited tax structures.

Creating leverage in international negotiations, using tariffs strategically in trade disputes.

Improving balance of trade by reducing imports and encouraging local production.

Tariffs and Development Strategy

Tariffs can support national development goals by helping countries control their economic exposure to global markets and by directing the growth of selected industries.

Infant Industry: A newly established sector that lacks the competitiveness of long-standing foreign producers and may require protection to develop.

After an infant industry is introduced, governments sometimes use temporary protection to build the skills, capital, and infrastructure needed for long-term competitiveness. This approach is often linked to broader state-led development strategies.

How Tariffs Shape Trade Flows

Because tariffs alter the price of imported goods, they influence the direction and scale of trade.

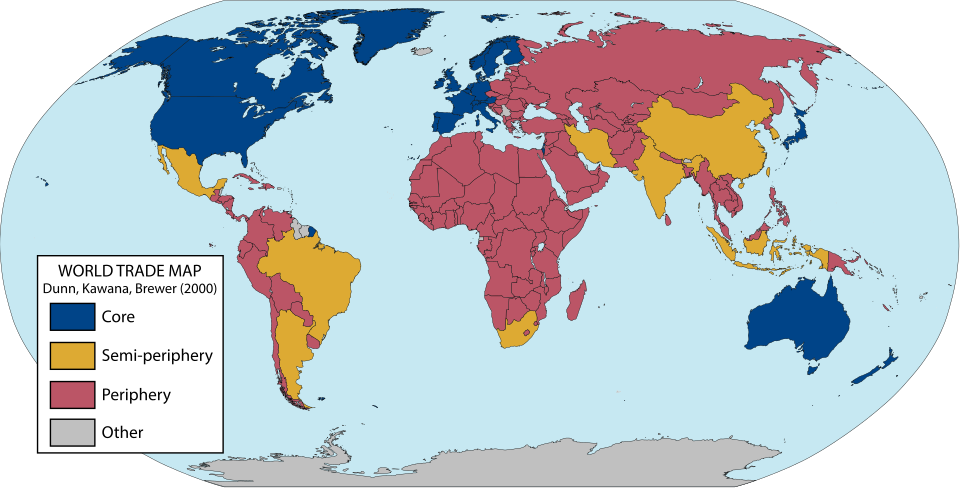

A world map showing major trade routes and the relative scale of flows between regions. The thickness of arrows indicates trade intensity, illustrating dominant global corridors. The map does not depict tariffs directly but shows the trade patterns that tariff policies can reshape. Source.

When tariffs are high:

Import volumes tend to decline.

Domestic producers may gain a larger share of the market.

Consumers may face higher prices due to reduced competition.

Trade partners may retaliate, shifting global trade patterns.

Normal economic interactions continue even when tariffs are applied; however, the composition of trade and the set of global connections a country maintains may shift significantly.

Spatial Patterns of Tariff Effects

Tariffs do not have uniform effects across space. Instead, their impacts vary by economic structure, industrial base, and level of development.

Core Countries

Core economies, with robust industrial sectors, often impose selective tariffs to protect advanced manufacturing or to gain leverage in trade negotiations. Their diversified economies can absorb disruptions more easily.

Semiperiphery Countries

Semiperiphery nations frequently use tariffs to nurture industrial growth and reduce reliance on imports. Tariff policies may help these states climb the value chain by supporting emerging manufacturing sectors.

Periphery Countries

Periphery states may rely on tariffs for government revenue or to protect small-scale domestic producers. However, their dependence on commodity exports and imported manufactured goods can make tariff use economically risky.

Tariffs and Industrial Location

Trade policies influence where industries locate by shifting incentives for domestic versus foreign production.

High tariffs may encourage import-substitution industrialization (ISI), in which firms locate domestically to avoid tariff costs.

Low or zero tariffs may encourage export-oriented industrialization (EOI), in which firms integrate into global production networks to access international markets.

Tariff-free special economic zones (SEZs) often attract foreign direct investment by offering regulatory and tax advantages.

These spatial patterns show how trade policy intertwines with broader processes of industrialization and development.

Tariffs and Multiscale Governance

Trade policies operate across multiple scales of governance:

National scale: central governments typically set tariff rates and negotiate trade agreements.

Regional scale: trade blocs such as the EU or Mercosur use common external tariffs to harmonize internal markets.

Local scale: port authorities, free-trade zones, and customs areas participate in implementing tariff regulations and shaping localized trade flows.

Such multiscale governance shapes how communities experience the economic consequences of global trade.

Tariffs, Globalization, and Development Trade-offs

Tariffs can support economic development, but they also generate trade-offs that shape how countries integrate into the global economy.

Benefits include:

Promoting domestic industrial growth

Protecting employment

Supporting strategic developmental objectives

Costs include:

Reduced consumer choice

Higher prices

Risk of international retaliation

Potential inefficiencies in protected industries

These trade-offs illustrate why tariffs play a central role in development debates and why government initiatives at multiple scales significantly influence economic trajectories.

FAQ

A tariff raises the price of imported goods through a tax, whereas a quota sets a physical limit on the quantity of goods allowed into a country.

Governments may choose tariffs when they want continued revenue and flexible control over import levels, since consumers can still import as much as they wish at the higher price.

Quotas are used when a government wants strict, guaranteed limits on imports, which can provide stronger protection for domestic industries but do not generate tax revenue.

Tariff escalation occurs when countries apply low tariffs on raw materials but much higher tariffs on processed or manufactured goods.

This structure encourages developing countries to export unprocessed commodities while discouraging investment in higher-value industries such as food processing, textiles, or machinery.

As a result, developing countries may struggle to diversify their economies or gain a larger share of global value-added production.

Digital goods and services often bypass traditional customs borders, making tariffs difficult or impossible to apply.

Governments must rely on alternative tools such as data regulation, digital service taxes, or restrictions on foreign technology firms.

These changes reduce the effectiveness of tariffs as a primary trade policy instrument, especially for economies shifting from manufacturing toward services.

Tariffs can encourage multinational firms to relocate production into the tariff-imposing country to avoid paying higher import taxes.

This can lead to:

Increased domestic manufacturing jobs

Growth of supply chains within the tariff-imposing state

Greater technology transfer and skill development

However, uncertainty caused by frequent tariff changes may discourage long-term investment.

Consumer attitudes depend on how tariffs affect prices, job security, and perceptions of fairness in international trade.

Support is more likely when consumers believe tariffs protect local employment or national industries.

Opposition grows when tariffs significantly raise the cost of everyday imported goods, reduce variety, or appear to trigger retaliatory increases from other countries.

Practice Questions

(1–3 marks)

Explain one way in which a government tariff can influence domestic industrial development.

Question 1 (1–3 marks)

1 mark for identifying a basic effect of a tariff (e.g., raises price of imports, reduces competition).

1 mark for explaining how this effect influences domestic industry (e.g., encourages consumers to buy domestic goods).

1 mark for linking this influence to development (e.g., allows an infant industry to grow, leading to increased production capacity).

Maximum: 3 marks

(4–6 marks)

Assess how tariff policies can produce uneven development outcomes between core, semi-periphery, and periphery states. Refer to economic processes discussed in the specification.

Question 2 (4–6 marks)

Award marks for any of the following:

1–2 marks for describing how tariffs operate (e.g., tariffs restrict imports, alter trade flows).

1–2 marks for explaining differential impacts by development level:

Core states may use tariffs strategically to protect advanced industries or gain leverage.

Semi-periphery states may rely on tariffs to nurture emerging manufacturing sectors.

Periphery states may depend on tariffs for revenue or protection but face risks due to reliance on imports.

1–2 marks for assessing uneven outcomes (e.g., tariffs may support industrial growth in semi-periphery states while harming consumer welfare in periphery states; retaliation may disadvantage weaker economies; core states often benefit from negotiation power).

Maximum: 6 marks